Fraud Prevention in Payment Processing: Strategies for Businesses

- in Finance

In the fast-paced world of digital transactions, safeguarding payment processing against fraud is paramount for businesses. The evolving landscape demands proactive strategies to protect both merchants and customers from the constant threat of fraudulent activities. In this article, we explore five key strategies that businesses can adopt to fortify their payment processing systems and build a secure digital environment.

Advanced Authentication Methods: Enhancing Security Layers

In the quest to combat fraud, businesses can implement advanced authentication methods from Tobacco Payment Processing providers to bolster security. Multi-factor authentication, incorporating elements like unique codes sent to mobile devices or biometric data, adds an extra layer of protection. By making it more challenging for fraudsters to gain unauthorized access, businesses enhance the overall security of their payment processing systems.

Regularly Update Security Protocols: Staying Ahead of Emerging Threats

The digital landscape is dynamic, and so are the tactics employed by fraudsters. Regularly updating security protocols is essential to stay ahead of potential threats. Routine software updates, patches, and security audits help identify vulnerabilities, ensuring that the payment processing system remains fortified against emerging risks. A proactive approach to security is a fundamental aspect of fraud prevention.

Real-Time Transaction Monitoring: Swift Detection and Intervention

Implementing real-time transaction monitoring is a powerful strategy for fraud prevention. Automated systems can analyze transaction data, flagging any anomalies or suspicious activities. Swift detection enables businesses to intervene immediately, preventing fraudulent transactions before they escalate. Real-time monitoring is a proactive measure that adds an extra layer of defense to the payment processing system.

Educate and Train Staff: Human Vigilance as a Line of Defense

Human error can contribute to vulnerabilities in the payment processing chain. Businesses should invest in educating and training staff on security best practices. Ensuring that team members recognize potential red flags, adhere to established protocols, and stay informed about the latest fraud trends empowers them to be a vigilant line of defense against fraudulent activities.

Collaborate With Fraud Prevention Services: Tapping Into Expertise

Engaging with specialized fraud prevention services is a strategic move for businesses seeking comprehensive protection. These services offer advanced tools, expertise, and real-time risk assessment. By partnering with professionals in the field, businesses gain access to transaction scoring, proactive measures, and dynamic insights that enhance their overall fraud prevention strategy.

In Conclusion

In the complex landscape of digital transactions, fraud prevention is not just a necessity. It’s a commitment to building trust and reliability. Businesses that prioritize security by adopting advanced authentication methods regularly update security protocols, implement real-time transaction monitoring, invest in staff education, and collaborate with specialized fraud prevention services to fortify their payment processing systems.…

Silver, the shining star of precious metals, has a rich history and continues to captivate investors worldwide. Known for its beautiful luster and versatile applications, silver holds immense value both in industrial sectors and as an investment asset. One key factor that makes silver an attractive investment is its affordability compared to other precious metals like gold or platinum. The

Silver, the shining star of precious metals, has a rich history and continues to captivate investors worldwide. Known for its beautiful luster and versatile applications, silver holds immense value both in industrial sectors and as an investment asset. One key factor that makes silver an attractive investment is its affordability compared to other precious metals like gold or platinum. The  Gold has long been considered one of the most valuable and sought-after precious metals. Its rich history dates back thousands of years, with civilizations across the globe recognizing its beauty and worth. Today, gold continues to hold a special place in the investment world. One of the reasons why gold is such a popular investment is its ability to act as a hedge against inflation. When paper currencies lose value, gold tends to retain or even increase its worth. This makes it an attractive option for those looking to preserve their wealth.

Gold has long been considered one of the most valuable and sought-after precious metals. Its rich history dates back thousands of years, with civilizations across the globe recognizing its beauty and worth. Today, gold continues to hold a special place in the investment world. One of the reasons why gold is such a popular investment is its ability to act as a hedge against inflation. When paper currencies lose value, gold tends to retain or even increase its worth. This makes it an attractive option for those looking to preserve their wealth.

When it comes to dividend stocks, many people assume that they are only suitable for income-focused investors. While it’s true that dividends can provide a steady stream of passive income, this is not the only reason to consider investing in dividend stocks. Dividend stocks can be a smart choice for any investor looking for long-term growth and stability.

When it comes to dividend stocks, many people assume that they are only suitable for income-focused investors. While it’s true that dividends can provide a steady stream of passive income, this is not the only reason to consider investing in dividend stocks. Dividend stocks can be a smart choice for any investor looking for long-term growth and stability.

The major factor that can lead to business

The major factor that can lead to business

While often touted as a stable investment, gold is not immune to volatility. Its value can experience significant fluctuations in response to various economic factors, including changes in interest rates, geopolitical events, and market sentiment. Unlike stocks or bonds, gold does not generate income in the form of dividends or interest. This lack of income generation can disadvantage entrepreneurs seeking regular cash flow from their investments, as it relies solely on price appreciation for potential returns.

While often touted as a stable investment, gold is not immune to volatility. Its value can experience significant fluctuations in response to various economic factors, including changes in interest rates, geopolitical events, and market sentiment. Unlike stocks or bonds, gold does not generate income in the form of dividends or interest. This lack of income generation can disadvantage entrepreneurs seeking regular cash flow from their investments, as it relies solely on price appreciation for potential returns.

While diversification is often a recommended strategy, relying too heavily on a single asset class like gold may lead to overexposure. Gold-backed IRAs focus solely on precious metals, which can create an imbalance in an entrepreneur’s overall investment portfolio. By investing exclusively in gold, entrepreneurs may miss out on the potential benefits of other asset classes, such as stocks, bonds, or real estate. Maintaining a well-diversified portfolio can help mitigate risks and capture growth opportunities across various sectors.

While diversification is often a recommended strategy, relying too heavily on a single asset class like gold may lead to overexposure. Gold-backed IRAs focus solely on precious metals, which can create an imbalance in an entrepreneur’s overall investment portfolio. By investing exclusively in gold, entrepreneurs may miss out on the potential benefits of other asset classes, such as stocks, bonds, or real estate. Maintaining a well-diversified portfolio can help mitigate risks and capture growth opportunities across various sectors.

One of the most common traps people fall into when navigating the healthcare insurance market is not understanding their policy options. Various types of policies are available, and it can be difficult to understand the difference between them. Understanding the difference between these policy types is crucial to choose the one that best fits your needs. If you’re unsure which type of policy is right for you, ask your insurance agent or broker for help.

One of the most common traps people fall into when navigating the healthcare insurance market is not understanding their policy options. Various types of policies are available, and it can be difficult to understand the difference between them. Understanding the difference between these policy types is crucial to choose the one that best fits your needs. If you’re unsure which type of policy is right for you, ask your insurance agent or broker for help. When it comes to healthcare insurance, one of the biggest traps people fall into is comparing multiple offers. It’s important to remember that not all healthcare plans are created equal, and what may work for one person may not work for another.

When it comes to healthcare insurance, one of the biggest traps people fall into is comparing multiple offers. It’s important to remember that not all healthcare plans are created equal, and what may work for one person may not work for another.

Do you ever look at your investment statement and wonder, “how much money did I actually make?” This is a great question to ask yourself, as net income is the most basic type of return you can receive from an investment. It’s simply the amount of money you earn after subtracting all expenses related to that particular investment.

Do you ever look at your investment statement and wonder, “how much money did I actually make?” This is a great question to ask yourself, as net income is the most basic type of return you can receive from an investment. It’s simply the amount of money you earn after subtracting all expenses related to that particular investment. Finally, total return refers to the combined performance of all four types of returns we’ve discussed above. It’s often expressed as a percentage, calculated by subtracting the initial cost of the investment from the final return (net income, dividend yield, and capital gains).

Finally, total return refers to the combined performance of all four types of returns we’ve discussed above. It’s often expressed as a percentage, calculated by subtracting the initial cost of the investment from the final return (net income, dividend yield, and capital gains).

One of the most important factors that lenders consider when evaluating a mortgage application is the borrower’s credit score. A credit score is a numerical representation of your creditworthiness based on factors such as your payment history, credit utilization, and the types of credit accounts you have. Lenders use your credit score to determine the risk of lending you money, and a higher credit score can make it easier to qualify for a mortgage and secure a lower interest rate.

One of the most important factors that lenders consider when evaluating a mortgage application is the borrower’s credit score. A credit score is a numerical representation of your creditworthiness based on factors such as your payment history, credit utilization, and the types of credit accounts you have. Lenders use your credit score to determine the risk of lending you money, and a higher credit score can make it easier to qualify for a mortgage and secure a lower interest rate.

Finally, it is essential to be prepared to provide the lender with the documentation needed to evaluate your mortgage application. This may include things like proof of income, proof of assets, and proof of identification. It is a good idea to gather these documents in advance, as it can make the application process go more smoothly and help to speed up the approval process.

Finally, it is essential to be prepared to provide the lender with the documentation needed to evaluate your mortgage application. This may include things like proof of income, proof of assets, and proof of identification. It is a good idea to gather these documents in advance, as it can make the application process go more smoothly and help to speed up the approval process.

One of the main reasons to move to Singapore is that it is a major financial center. The city-state has one of the busiest ports in the world and is a global hub for finance, banking, trading, and investing. As such, there are plenty of opportunities for those looking to start or advance their careers in finance.

One of the main reasons to move to Singapore is that it is a major financial center. The city-state has one of the busiest ports in the world and is a global hub for finance, banking, trading, and investing. As such, there are plenty of opportunities for those looking to start or advance their careers in finance. Although Singapore has a high cost of living compared to some parts of Southeast Asia, it is still relatively affordable compared to other major cities worldwide. This makes it easier for those looking to move to Singapore, as they won’t have to worry about spending too much money on basic necessities.

Although Singapore has a high cost of living compared to some parts of Southeast Asia, it is still relatively affordable compared to other major cities worldwide. This makes it easier for those looking to move to Singapore, as they won’t have to worry about spending too much money on basic necessities.

Another critical feature to look for in a trading bot is execution speed. In the fast-paced world of cryptocurrency trading, every second counts. It would help if you were sure that your bot could place trades quickly and efficiently. Otherwise, you could miss out on some profitable opportunities. In addition to speed, your bot should also have a good track record of executing trades successfully.

Another critical feature to look for in a trading bot is execution speed. In the fast-paced world of cryptocurrency trading, every second counts. It would help if you were sure that your bot could place trades quickly and efficiently. Otherwise, you could miss out on some profitable opportunities. In addition to speed, your bot should also have a good track record of executing trades successfully.

Finally, you’ll want to ensure that your bot implements

Finally, you’ll want to ensure that your bot implements

One of the biggest advantages of getting a chattel mortgage is that it offers tax benefits. When you finance a vehicle through a traditional loan, you must pay taxes on the full purchase price. However, with a chattel mortgage, you are only required to pay taxes on the portion of the vehicle’s value that you are borrowing. This can save you a significant amount of money at tax time. Many people have found that the tax savings alone make getting a chattel mortgage worth it. Many people do not know about this at all.

One of the biggest advantages of getting a chattel mortgage is that it offers tax benefits. When you finance a vehicle through a traditional loan, you must pay taxes on the full purchase price. However, with a chattel mortgage, you are only required to pay taxes on the portion of the vehicle’s value that you are borrowing. This can save you a significant amount of money at tax time. Many people have found that the tax savings alone make getting a chattel mortgage worth it. Many people do not know about this at all. The last advantage of getting a chattel mortgage is that they offer flexible repayment terms. With a traditional loan, you are typically required to make monthly payments over a set period. However, with a chattel mortgage, you can often choose how often you make payments and how much you pay each time. This can be helpful if your income fluctuates or if you need extra flexibility in your budget. This is very helpful for small business owners. In fact, many small business owners choose chattel mortgages for this very reason.

The last advantage of getting a chattel mortgage is that they offer flexible repayment terms. With a traditional loan, you are typically required to make monthly payments over a set period. However, with a chattel mortgage, you can often choose how often you make payments and how much you pay each time. This can be helpful if your income fluctuates or if you need extra flexibility in your budget. This is very helpful for small business owners. In fact, many small business owners choose chattel mortgages for this very reason.

One of the best things to improve your financial situation is to pay off your credit card debt. Credit card debt can be a major drag on your finances. The interest that you are paying on your credit cards is likely much higher than the interest you are earning on your savings. This means that you are losing money by carrying a balance on your credit cards.

One of the best things to improve your financial situation is to pay off your credit card debt. Credit card debt can be a major drag on your finances. The interest that you are paying on your credit cards is likely much higher than the interest you are earning on your savings. This means that you are losing money by carrying a balance on your credit cards. One of the best things you can do to increase your net worth is to invest in yourself. This means taking care of your health, investing in your education and career, and building positive relationships. When you invest in yourself, you increase your human capital, which is one of the most important assets. Increasing your net worth is not as difficult as you may think. With a little bit of effort, you …

One of the best things you can do to increase your net worth is to invest in yourself. This means taking care of your health, investing in your education and career, and building positive relationships. When you invest in yourself, you increase your human capital, which is one of the most important assets. Increasing your net worth is not as difficult as you may think. With a little bit of effort, you …

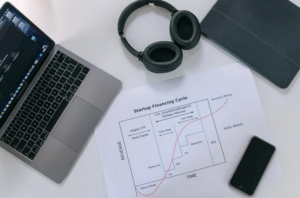

The application process for startup accelerators is typically very rigorous. Entrepreneurs must undergo a competitive selection process to be accepted into these programs. The accelerators only want to work with the best and most promising startups. In addition to a written application, entrepreneurs often have to pitch their business idea to a panel of judges.

The application process for startup accelerators is typically very rigorous. Entrepreneurs must undergo a competitive selection process to be accepted into these programs. The accelerators only want to work with the best and most promising startups. In addition to a written application, entrepreneurs often have to pitch their business idea to a panel of judges. Most startup accelerators are cohort-based. This means that the businesses that participate in these programs are all at the same stage of development. This can be beneficial for entrepreneurs as it allows them to collaborate with others going through the same experience. It also creates a sense of community and support system. Besides being cohort-based, many startup accelerators are also location-based. This means that the businesses that participate in these programs are all located in the same city or region.

Most startup accelerators are cohort-based. This means that the businesses that participate in these programs are all at the same stage of development. This can be beneficial for entrepreneurs as it allows them to collaborate with others going through the same experience. It also creates a sense of community and support system. Besides being cohort-based, many startup accelerators are also location-based. This means that the businesses that participate in these programs are all located in the same city or region.

The first thing you need to do is decide which type of metal to invest in. There are a variety of metals on the market, including gold, silver, platinum, and palladium. Each one has its own unique properties and benefits. Gold is perhaps the most well-known precious metal.

The first thing you need to do is decide which type of metal to invest in. There are a variety of metals on the market, including gold, silver, platinum, and palladium. Each one has its own unique properties and benefits. Gold is perhaps the most well-known precious metal. Another important thing to consider when investing in precious metals is timing. You want to buy them at the right time so you can get the best price possible. The best time to buy gold and silver is when the market is down. On the other hand, Platinum and palladium are better bought when the market is up. So do your research and be aware of current market conditions before you make any investments.

Another important thing to consider when investing in precious metals is timing. You want to buy them at the right time so you can get the best price possible. The best time to buy gold and silver is when the market is down. On the other hand, Platinum and palladium are better bought when the market is up. So do your research and be aware of current market conditions before you make any investments.

Another benefit of life insurance is the tax benefits. Policies can often be written to allow the premiums to be tax-deductible. This can save you a lot of money in the long run. Many people like this because it allows them to save money as well. If you are gone, your loved ones will not worry about the taxes. However, if you have life insurance, the payout from the policy can be used to cover these costs. This is a significant benefit and something that should not be overlooked.

Another benefit of life insurance is the tax benefits. Policies can often be written to allow the premiums to be tax-deductible. This can save you a lot of money in the long run. Many people like this because it allows them to save money as well. If you are gone, your loved ones will not worry about the taxes. However, if you have life insurance, the payout from the policy can be used to cover these costs. This is a significant benefit and something that should not be overlooked. Perhaps the most significant benefit of life insurance is the peace of mind it provides. Knowing that your family will be taken care of financially if something happens to you is a huge weight off your shoulders. If you’re considering purchasing life insurance, make sure to do your research and find a policy that fits your needs. This is very important to rest assured that your family is taken care of in case of an emergency.

Perhaps the most significant benefit of life insurance is the peace of mind it provides. Knowing that your family will be taken care of financially if something happens to you is a huge weight off your shoulders. If you’re considering purchasing life insurance, make sure to do your research and find a policy that fits your needs. This is very important to rest assured that your family is taken care of in case of an emergency.

The exchange you choose should be easy to use for someone who is not an expert. If the user interface seems confusing, it may be difficult to trade cryptocurrency.

The exchange you choose should be easy to use for someone who is not an expert. If the user interface seems confusing, it may be difficult to trade cryptocurrency. Customer support is another essential factor to consider. If you have any questions or run into any problems, you want to be sure that someone can help you out. Good customer support can make all the difference in resolving an issue. They must also be very responsive; you do not want to be left in the dark if something goes wrong.

Customer support is another essential factor to consider. If you have any questions or run into any problems, you want to be sure that someone can help you out. Good customer support can make all the difference in resolving an issue. They must also be very responsive; you do not want to be left in the dark if something goes wrong.

One of the most important factors to consider when choosing a payroll system is its cost. Most services have both a monthly subscription fee and per-paycheck processing fees. Make sure you understand all of the costs of using a particular system before signing up.

One of the most important factors to consider when choosing a payroll system is its cost. Most services have both a monthly subscription fee and per-paycheck processing fees. Make sure you understand all of the costs of using a particular system before signing up.