Top Common Forex Scams: Millennial Traders Beware

- in Finance

As exciting as it may seem, for young traders like us, it’s more than important to be fully aware of the potential risks and pitfalls that await you. Although the best forex broker Australia is available to help, forex trading isn’t just about making quick profits; it’s also a breeding ground for scammers and fraudsters looking to take advantage of inexperienced traders. In this blog post, we will shed light on some of the most common scams targeting young traders like yourself and how you can avoid these scams like a pro.

Signal Seller Scams

Signal seller scams are one of the most prevalent types of forex fraud targeting unsuspecting traders. These scammers claim to have insider information or advanced algorithms that can predict market movements with uncanny accuracy. They often use flashy marketing techniques, showcasing luxurious lifestyles and extravagant promises of overnight success. Once you’ve signed up and started using their signals, however, reality sets in. The trades recommended by these signal sellers consistently lead to losses rather than gains.

You begin to question their expertise and realize that you may have fallen victim to a well-crafted scam. So, how do these scammers operate? They typically charge exorbitant fees for their signal services while providing little or no real value in return. Some even manipulate trade results or cherry-pick winning trades to deceive traders into thinking they’re legitimate.

Robot Scams (Automated Trading Systems)

In the world of forex trading, automation can be a double-edged sword. On one hand, it can offer convenience and efficiency to traders who want to take advantage of market opportunities 24/7. On the other hand, it opens up a whole new avenue for scammers to exploit unsuspecting millennial traders. However, many of these robot scams are nothing more than smoke and mirrors. They lure in traders with flashy websites, testimonials from supposed satisfied customers, and promises of financial freedom. But once you invest your hard-earned money into their system, you quickly realize that the results are far from what was advertised.

The sad truth is that most of these robot scams are designed by unscrupulous individuals looking to make a quick buck at your expense. The algorithms they claim to use are often faulty or non-existent, leading to significant losses rather than profits. In some cases, these scam artists may even manipulate trade results or refuse withdrawals altogether.

Fake Forex Investment Funds

In these scams, fraudsters set up fake investment funds that claim to specialize in forex trading. They may even create impressive websites and promotional materials to convince potential victims of their credibility. These funds promise guaranteed profits through expert trading strategies or proprietary algorithms. Once investors deposit their money into these fake funds, they quickly discover that it is all a ruse. The scammers disappear with the funds, leaving behind devastated investors who have lost their hard-earned money.

Phony Forex Brokers (Bucket Shops)

Also known as Bucket Shops, these brokers are just a bunch of scammers in forex trading. These fraudulent brokers operate …

The major factor that can lead to business

The major factor that can lead to business

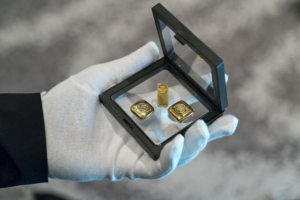

While often touted as a stable investment, gold is not immune to volatility. Its value can experience significant fluctuations in response to various economic factors, including changes in interest rates, geopolitical events, and market sentiment. Unlike stocks or bonds, gold does not generate income in the form of dividends or interest. This lack of income generation can disadvantage entrepreneurs seeking regular cash flow from their investments, as it relies solely on price appreciation for potential returns.

While often touted as a stable investment, gold is not immune to volatility. Its value can experience significant fluctuations in response to various economic factors, including changes in interest rates, geopolitical events, and market sentiment. Unlike stocks or bonds, gold does not generate income in the form of dividends or interest. This lack of income generation can disadvantage entrepreneurs seeking regular cash flow from their investments, as it relies solely on price appreciation for potential returns.

While diversification is often a recommended strategy, relying too heavily on a single asset class like gold may lead to overexposure. Gold-backed IRAs focus solely on precious metals, which can create an imbalance in an entrepreneur’s overall investment portfolio. By investing exclusively in gold, entrepreneurs may miss out on the potential benefits of other asset classes, such as stocks, bonds, or real estate. Maintaining a well-diversified portfolio can help mitigate risks and capture growth opportunities across various sectors.

While diversification is often a recommended strategy, relying too heavily on a single asset class like gold may lead to overexposure. Gold-backed IRAs focus solely on precious metals, which can create an imbalance in an entrepreneur’s overall investment portfolio. By investing exclusively in gold, entrepreneurs may miss out on the potential benefits of other asset classes, such as stocks, bonds, or real estate. Maintaining a well-diversified portfolio can help mitigate risks and capture growth opportunities across various sectors.

One of the most important factors that lenders consider when evaluating a mortgage application is the borrower’s credit score. A credit score is a numerical representation of your creditworthiness based on factors such as your payment history, credit utilization, and the types of credit accounts you have. Lenders use your credit score to determine the risk of lending you money, and a higher credit score can make it easier to qualify for a mortgage and secure a lower interest rate.

One of the most important factors that lenders consider when evaluating a mortgage application is the borrower’s credit score. A credit score is a numerical representation of your creditworthiness based on factors such as your payment history, credit utilization, and the types of credit accounts you have. Lenders use your credit score to determine the risk of lending you money, and a higher credit score can make it easier to qualify for a mortgage and secure a lower interest rate.

Finally, it is essential to be prepared to provide the lender with the documentation needed to evaluate your mortgage application. This may include things like proof of income, proof of assets, and proof of identification. It is a good idea to gather these documents in advance, as it can make the application process go more smoothly and help to speed up the approval process.

Finally, it is essential to be prepared to provide the lender with the documentation needed to evaluate your mortgage application. This may include things like proof of income, proof of assets, and proof of identification. It is a good idea to gather these documents in advance, as it can make the application process go more smoothly and help to speed up the approval process.

Another critical feature to look for in a trading bot is execution speed. In the fast-paced world of cryptocurrency trading, every second counts. It would help if you were sure that your bot could place trades quickly and efficiently. Otherwise, you could miss out on some profitable opportunities. In addition to speed, your bot should also have a good track record of executing trades successfully.

Another critical feature to look for in a trading bot is execution speed. In the fast-paced world of cryptocurrency trading, every second counts. It would help if you were sure that your bot could place trades quickly and efficiently. Otherwise, you could miss out on some profitable opportunities. In addition to speed, your bot should also have a good track record of executing trades successfully.

Finally, you’ll want to ensure that your bot implements

Finally, you’ll want to ensure that your bot implements

One of the biggest advantages of getting a chattel mortgage is that it offers tax benefits. When you finance a vehicle through a traditional loan, you must pay taxes on the full purchase price. However, with a chattel mortgage, you are only required to pay taxes on the portion of the vehicle’s value that you are borrowing. This can save you a significant amount of money at tax time. Many people have found that the tax savings alone make getting a chattel mortgage worth it. Many people do not know about this at all.

One of the biggest advantages of getting a chattel mortgage is that it offers tax benefits. When you finance a vehicle through a traditional loan, you must pay taxes on the full purchase price. However, with a chattel mortgage, you are only required to pay taxes on the portion of the vehicle’s value that you are borrowing. This can save you a significant amount of money at tax time. Many people have found that the tax savings alone make getting a chattel mortgage worth it. Many people do not know about this at all. The last advantage of getting a chattel mortgage is that they offer flexible repayment terms. With a traditional loan, you are typically required to make monthly payments over a set period. However, with a chattel mortgage, you can often choose how often you make payments and how much you pay each time. This can be helpful if your income fluctuates or if you need extra flexibility in your budget. This is very helpful for small business owners. In fact, many small business owners choose chattel mortgages for this very reason.

The last advantage of getting a chattel mortgage is that they offer flexible repayment terms. With a traditional loan, you are typically required to make monthly payments over a set period. However, with a chattel mortgage, you can often choose how often you make payments and how much you pay each time. This can be helpful if your income fluctuates or if you need extra flexibility in your budget. This is very helpful for small business owners. In fact, many small business owners choose chattel mortgages for this very reason.

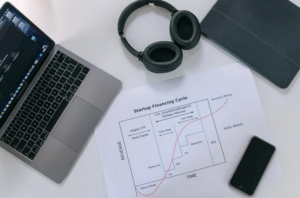

The application process for startup accelerators is typically very rigorous. Entrepreneurs must undergo a competitive selection process to be accepted into these programs. The accelerators only want to work with the best and most promising startups. In addition to a written application, entrepreneurs often have to pitch their business idea to a panel of judges.

The application process for startup accelerators is typically very rigorous. Entrepreneurs must undergo a competitive selection process to be accepted into these programs. The accelerators only want to work with the best and most promising startups. In addition to a written application, entrepreneurs often have to pitch their business idea to a panel of judges. Most startup accelerators are cohort-based. This means that the businesses that participate in these programs are all at the same stage of development. This can be beneficial for entrepreneurs as it allows them to collaborate with others going through the same experience. It also creates a sense of community and support system. Besides being cohort-based, many startup accelerators are also location-based. This means that the businesses that participate in these programs are all located in the same city or region.

Most startup accelerators are cohort-based. This means that the businesses that participate in these programs are all at the same stage of development. This can be beneficial for entrepreneurs as it allows them to collaborate with others going through the same experience. It also creates a sense of community and support system. Besides being cohort-based, many startup accelerators are also location-based. This means that the businesses that participate in these programs are all located in the same city or region.

The first thing you need to do is decide which type of metal to invest in. There are a variety of metals on the market, including gold, silver, platinum, and palladium. Each one has its own unique properties and benefits. Gold is perhaps the most well-known precious metal.

The first thing you need to do is decide which type of metal to invest in. There are a variety of metals on the market, including gold, silver, platinum, and palladium. Each one has its own unique properties and benefits. Gold is perhaps the most well-known precious metal. Another important thing to consider when investing in precious metals is timing. You want to buy them at the right time so you can get the best price possible. The best time to buy gold and silver is when the market is down. On the other hand, Platinum and palladium are better bought when the market is up. So do your research and be aware of current market conditions before you make any investments.

Another important thing to consider when investing in precious metals is timing. You want to buy them at the right time so you can get the best price possible. The best time to buy gold and silver is when the market is down. On the other hand, Platinum and palladium are better bought when the market is up. So do your research and be aware of current market conditions before you make any investments.

Another benefit of life insurance is the tax benefits. Policies can often be written to allow the premiums to be tax-deductible. This can save you a lot of money in the long run. Many people like this because it allows them to save money as well. If you are gone, your loved ones will not worry about the taxes. However, if you have life insurance, the payout from the policy can be used to cover these costs. This is a significant benefit and something that should not be overlooked.

Another benefit of life insurance is the tax benefits. Policies can often be written to allow the premiums to be tax-deductible. This can save you a lot of money in the long run. Many people like this because it allows them to save money as well. If you are gone, your loved ones will not worry about the taxes. However, if you have life insurance, the payout from the policy can be used to cover these costs. This is a significant benefit and something that should not be overlooked. Perhaps the most significant benefit of life insurance is the peace of mind it provides. Knowing that your family will be taken care of financially if something happens to you is a huge weight off your shoulders. If you’re considering purchasing life insurance, make sure to do your research and find a policy that fits your needs. This is very important to rest assured that your family is taken care of in case of an emergency.

Perhaps the most significant benefit of life insurance is the peace of mind it provides. Knowing that your family will be taken care of financially if something happens to you is a huge weight off your shoulders. If you’re considering purchasing life insurance, make sure to do your research and find a policy that fits your needs. This is very important to rest assured that your family is taken care of in case of an emergency.

The exchange you choose should be easy to use for someone who is not an expert. If the user interface seems confusing, it may be difficult to trade cryptocurrency.

The exchange you choose should be easy to use for someone who is not an expert. If the user interface seems confusing, it may be difficult to trade cryptocurrency. Customer support is another essential factor to consider. If you have any questions or run into any problems, you want to be sure that someone can help you out. Good customer support can make all the difference in resolving an issue. They must also be very responsive; you do not want to be left in the dark if something goes wrong.

Customer support is another essential factor to consider. If you have any questions or run into any problems, you want to be sure that someone can help you out. Good customer support can make all the difference in resolving an issue. They must also be very responsive; you do not want to be left in the dark if something goes wrong.

Don’t be that guy who goes out there and hunts during a time when it is not allowed, such as mating season of an animal you’re trying to track, because if you do this, then it’s more likely than not that all your

Don’t be that guy who goes out there and hunts during a time when it is not allowed, such as mating season of an animal you’re trying to track, because if you do this, then it’s more likely than not that all your

A competent and

A competent and  To avoid surprises, ask lots of questions: are they able to do the monthly accounting and taxes for the business? What is the cost of their services? Finding a professional who “gets you” can be as tricky as finding a good hairstylist. Ask if someone you know recommends an accountant. Ask about their preferences. Ask them about the services they receive and the prices. Don’t be tempted by promises of extensive checks after you’ve filed your tax return. Always check their qualifications and previous experience. Ask for references if you are unsure.

To avoid surprises, ask lots of questions: are they able to do the monthly accounting and taxes for the business? What is the cost of their services? Finding a professional who “gets you” can be as tricky as finding a good hairstylist. Ask if someone you know recommends an accountant. Ask about their preferences. Ask them about the services they receive and the prices. Don’t be tempted by promises of extensive checks after you’ve filed your tax return. Always check their qualifications and previous experience. Ask for references if you are unsure. It’s essential to know your duties in advance: are you able to do everything asked of you? Can you email them electronic copies or visit their office? Does the way they work meet your expectations? Although accountants are not known for their customer service skills, this is an essential aspect of their job. You may not hear from them for several days.

It’s essential to know your duties in advance: are you able to do everything asked of you? Can you email them electronic copies or visit their office? Does the way they work meet your expectations? Although accountants are not known for their customer service skills, this is an essential aspect of their job. You may not hear from them for several days.

The most important reason it’s easy to trade is that it requires very little money to start forex trading, and along with the abundance of leverage that comes with it, you can make a lot of money. However, the scammers do not mention that it is just as easy to lose a fantastic amount of money; you could lose more than you have in your account. Secondly, do not take the entire amount of leverage that is available to you. On the other hand, if you jump in and take the real influence, you can wipe out everything in one trade. Finally, please take the opportunity to learn how to trade, and put in the hard work it takes to be a great trader.

The most important reason it’s easy to trade is that it requires very little money to start forex trading, and along with the abundance of leverage that comes with it, you can make a lot of money. However, the scammers do not mention that it is just as easy to lose a fantastic amount of money; you could lose more than you have in your account. Secondly, do not take the entire amount of leverage that is available to you. On the other hand, if you jump in and take the real influence, you can wipe out everything in one trade. Finally, please take the opportunity to learn how to trade, and put in the hard work it takes to be a great trader. It takes some time to develop into a fantastic forex trader who needs patience. However, you will discover that as you understand how to trade, your performance will begin to compose itself, and you will begin to earn the kind of money you have always wanted and much more. Alternatively, you could make an extremely wonderful dwelling in your forex trading by reacting to where the market has gone along with doing this as quickly as possible, as success in this market is measured in time and speed.

It takes some time to develop into a fantastic forex trader who needs patience. However, you will discover that as you understand how to trade, your performance will begin to compose itself, and you will begin to earn the kind of money you have always wanted and much more. Alternatively, you could make an extremely wonderful dwelling in your forex trading by reacting to where the market has gone along with doing this as quickly as possible, as success in this market is measured in time and speed.

Should you seek the services of these creditors, it’s crucial you will have the ability to receive plenty of advantages. When you’ve got bad credit documents, and if you would like money quickly, it’s wise that you have to avail them whenever possible. The creditors won’t assess the credit completely, and they’ll offer these funds even in the event that you’ve got terrible credit records.

Should you seek the services of these creditors, it’s crucial you will have the ability to receive plenty of advantages. When you’ve got bad credit documents, and if you would like money quickly, it’s wise that you have to avail them whenever possible. The creditors won’t assess the credit completely, and they’ll offer these funds even in the event that you’ve got terrible credit records.

There are many reasons to buy travel insurance because of its benefits. For instance, you can protect your items,

There are many reasons to buy travel insurance because of its benefits. For instance, you can protect your items,  It’s important to figure out what coverage you have through your home or health insurance, or credit card. But travel insurance policies, in particular, offer coverage for travel cancellations/interruptions, which protects your financial plan. And not all health insurance programs offer comprehensive coverage …

It’s important to figure out what coverage you have through your home or health insurance, or credit card. But travel insurance policies, in particular, offer coverage for travel cancellations/interruptions, which protects your financial plan. And not all health insurance programs offer comprehensive coverage …

Many people tend to believe that only credit repair companies can repair credits. But on the contrary, a credit repair company can do nothing for you that you can’t do for yourself. Many pieces of information are available in books and online that you can use as a reference to familiarize yourself with how credit works and what you can do to repair your credit.

Many people tend to believe that only credit repair companies can repair credits. But on the contrary, a credit repair company can do nothing for you that you can’t do for yourself. Many pieces of information are available in books and online that you can use as a reference to familiarize yourself with how credit works and what you can do to repair your credit.

An overdraft account is one of the recommended ways to get an interest-free loan of up to £1,200. One of the accounts is the 123 Santander checking account, which also offers additional benefits. Besides, you get a return of money concerning the direct debits you make. In this case, you can get the cashback for your daily needs in different ways, such as three percent on communications bills such as mobile phones, digital TV, and broadband. You can also get two percent on gas and electricity bills, including one percent on water and municipal taxes. However, you will have to pay £500 and a £2 account bill per month. Also, you should pay attention to the overdraft limit. In case you exceed it, you will get charged with huge interest.

An overdraft account is one of the recommended ways to get an interest-free loan of up to £1,200. One of the accounts is the 123 Santander checking account, which also offers additional benefits. Besides, you get a return of money concerning the direct debits you make. In this case, you can get the cashback for your daily needs in different ways, such as three percent on communications bills such as mobile phones, digital TV, and broadband. You can also get two percent on gas and electricity bills, including one percent on water and municipal taxes. However, you will have to pay £500 and a £2 account bill per month. Also, you should pay attention to the overdraft limit. In case you exceed it, you will get charged with huge interest. Taking out a credit card with 0% interest on new purchases can be another way to get an interest-free loan. In this case, you can opt for Halifax All in One credit card or Nationwide Select credit card available for Nationwide Flex account current holders. These two cards are the best 0% purchase credit cards. Both differ in their higher credit limit (depending on your credit rating) and the period in which you get 0% interest on new purchases (usually between 15 and 18 months). However, like an overdrafts account, these loans can only be used for a shorter period. If not, you can get charged with terrible interest. Therefore, ensure to clear your balance before the 0% offer ends. Another thing to keep in mind is that you have to pay monthly to avoid paying late penalties or losing the 0% offer.

Taking out a credit card with 0% interest on new purchases can be another way to get an interest-free loan. In this case, you can opt for Halifax All in One credit card or Nationwide Select credit card available for Nationwide Flex account current holders. These two cards are the best 0% purchase credit cards. Both differ in their higher credit limit (depending on your credit rating) and the period in which you get 0% interest on new purchases (usually between 15 and 18 months). However, like an overdrafts account, these loans can only be used for a shorter period. If not, you can get charged with terrible interest. Therefore, ensure to clear your balance before the 0% offer ends. Another thing to keep in mind is that you have to pay monthly to avoid paying late penalties or losing the 0% offer.

One way you may think about doing this is by simply opening a new bank accounts which you simply use for business-related trades and putting all of your business-related buys on a credit or debit card connected to this account you don’t use for anything else. Maintaining your account different can help save time when you file your tax return or your expenses.

One way you may think about doing this is by simply opening a new bank accounts which you simply use for business-related trades and putting all of your business-related buys on a credit or debit card connected to this account you don’t use for anything else. Maintaining your account different can help save time when you file your tax return or your expenses.