Why Gold-Backed IRAs May Not Be the Best Investment Strategy

- in Finance

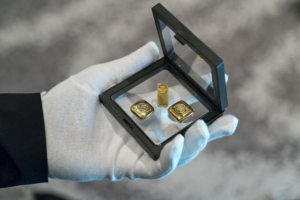

Are you considering investing in a gold-backed IRA? While the allure of having a precious metal as the foundation of your retirement portfolio may seem enticing, it’s essential to take a closer look at whether or not this investment strategy is truly optimal.

In this blog post, we’ll explore some potential drawbacks and pitfalls of relying on gold for your long-term financial security. So buckle up and get ready to discover why gold backed iras may not be the best choice for you.

Volatility and Lack of Income Generation

While often touted as a stable investment, gold is not immune to volatility. Its value can experience significant fluctuations in response to various economic factors, including changes in interest rates, geopolitical events, and market sentiment. Unlike stocks or bonds, gold does not generate income in the form of dividends or interest. This lack of income generation can disadvantage entrepreneurs seeking regular cash flow from their investments, as it relies solely on price appreciation for potential returns.

While often touted as a stable investment, gold is not immune to volatility. Its value can experience significant fluctuations in response to various economic factors, including changes in interest rates, geopolitical events, and market sentiment. Unlike stocks or bonds, gold does not generate income in the form of dividends or interest. This lack of income generation can disadvantage entrepreneurs seeking regular cash flow from their investments, as it relies solely on price appreciation for potential returns.

Storage and Custodial Costs

Investing in physical gold through a gold-backed IRA involves additional costs for secure storage and custodial services. Safeguarding physical gold requires secure vaults or depositories, which can come with associated fees. These costs may eat into potential returns and reduce the overall profitability of the investment. Entrepreneurs who are conscious of minimizing expenses or seeking more cost-effective investment options may find the additional costs associated with a gold-backed IRA prohibitive.

Limited Growth Potential

Although gold has historically shown some appreciation over the long term, its growth potential is relatively limited compared to other investment options, such as stocks or real estate. While it can serve as a hedge against inflation, gold’s price performance has not consistently outpaced the returns of other asset classes over extended periods. Entrepreneurs with a higher risk tolerance may seek investments with greater growth potential to maximize their retirement savings, potentially making a gold-backed IRA less appealing.

Lack of Control and Liquidity

Investing in a Gold Backed IRA means relying on custodians or financial institutions to manage and store the physical gold. This arrangement can limit an entrepreneur’s control over their investment. Selling or liquidating gold from an IRA may involve additional hurdles, such as specific rules and regulations, potentially causing delays and limiting liquidity. Entrepreneurs who value flexibility and direct control over their investments may prefer assets with greater liquidity and ease of access.

Potential Overexposure to Precious Metals

While diversification is often a recommended strategy, relying too heavily on a single asset class like gold may lead to overexposure. Gold-backed IRAs focus solely on precious metals, which can create an imbalance in an entrepreneur’s overall investment portfolio. By investing exclusively in gold, entrepreneurs may miss out on the potential benefits of other asset classes, such as stocks, bonds, or real estate. Maintaining a well-diversified portfolio can help mitigate risks and capture growth opportunities across various sectors.

While diversification is often a recommended strategy, relying too heavily on a single asset class like gold may lead to overexposure. Gold-backed IRAs focus solely on precious metals, which can create an imbalance in an entrepreneur’s overall investment portfolio. By investing exclusively in gold, entrepreneurs may miss out on the potential benefits of other asset classes, such as stocks, bonds, or real estate. Maintaining a well-diversified portfolio can help mitigate risks and capture growth opportunities across various sectors.

Investing in a gold-backed IRA is a decision that requires careful consideration, as it comes with its own …

Another critical feature to look for in a trading bot is execution speed. In the fast-paced world of cryptocurrency trading, every second counts. It would help if you were sure that your bot could place trades quickly and efficiently. Otherwise, you could miss out on some profitable opportunities. In addition to speed, your bot should also have a good track record of executing trades successfully.

Another critical feature to look for in a trading bot is execution speed. In the fast-paced world of cryptocurrency trading, every second counts. It would help if you were sure that your bot could place trades quickly and efficiently. Otherwise, you could miss out on some profitable opportunities. In addition to speed, your bot should also have a good track record of executing trades successfully.

Finally, you’ll want to ensure that your bot implements

Finally, you’ll want to ensure that your bot implements

The first thing you need to do is decide which type of metal to invest in. There are a variety of metals on the market, including gold, silver, platinum, and palladium. Each one has its own unique properties and benefits. Gold is perhaps the most well-known precious metal.

The first thing you need to do is decide which type of metal to invest in. There are a variety of metals on the market, including gold, silver, platinum, and palladium. Each one has its own unique properties and benefits. Gold is perhaps the most well-known precious metal. Another important thing to consider when investing in precious metals is timing. You want to buy them at the right time so you can get the best price possible. The best time to buy gold and silver is when the market is down. On the other hand, Platinum and palladium are better bought when the market is up. So do your research and be aware of current market conditions before you make any investments.

Another important thing to consider when investing in precious metals is timing. You want to buy them at the right time so you can get the best price possible. The best time to buy gold and silver is when the market is down. On the other hand, Platinum and palladium are better bought when the market is up. So do your research and be aware of current market conditions before you make any investments.

The exchange you choose should be easy to use for someone who is not an expert. If the user interface seems confusing, it may be difficult to trade cryptocurrency.

The exchange you choose should be easy to use for someone who is not an expert. If the user interface seems confusing, it may be difficult to trade cryptocurrency. Customer support is another essential factor to consider. If you have any questions or run into any problems, you want to be sure that someone can help you out. Good customer support can make all the difference in resolving an issue. They must also be very responsive; you do not want to be left in the dark if something goes wrong.

Customer support is another essential factor to consider. If you have any questions or run into any problems, you want to be sure that someone can help you out. Good customer support can make all the difference in resolving an issue. They must also be very responsive; you do not want to be left in the dark if something goes wrong.